Fourth quarter highlights:

National aggregate home price increased 4.3% year over year in Q4 2023; decreased 1.7% quarter over quarter

Aggregate home price in greater regions of Toronto, Montreal and Vancouver posted gains of 5.1%, 4.1% and 2.7% year over year, respectively, in final quarter of 2023

Among report’s major regions, Calgary recorded highest year over year price appreciation (10.7%); only major region to post quarterly price gains in Q4 2023 (1.5% over Q3)

81% of regional markets posted a quarter-over-quarter decline

Approximately 2.2 million mortgages in Canada will be renewing over the next two years, most at a much higher interest rate

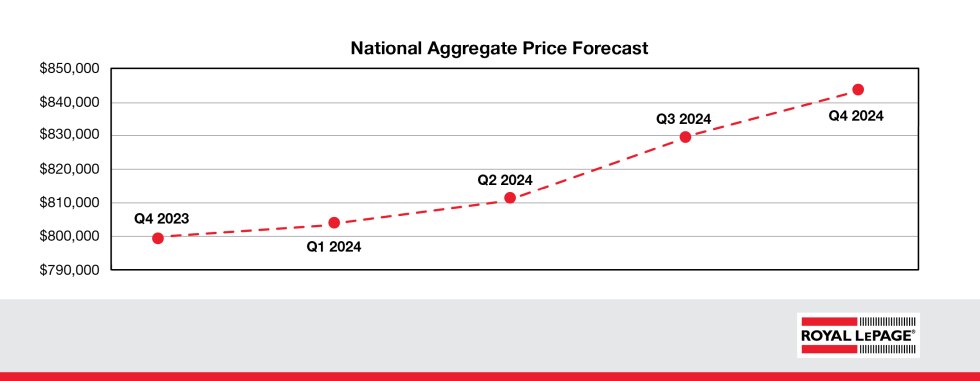

National aggregate home price expected to rise 5.5% year over year in Q4 of 2024

Interest rates and mortgage renewals

In December, the Bank of Canada once again held its key lending rate steady at 5.0 per cent.[3] The central bank has indicated that it has likely concluded its interest rate increase campaign, and it is widely expected to make modest cuts later this year. Meanwhile, several major financial institutions have already begun offering discounts on fixed-rate mortgages as bond yields decline.

“The Bank of Canada governing council will soon face the difficult task of trying to balance the lowering of interest rates without simultaneously stimulating spending, which would cause inflation to rise again,” said Soper.

In November, the Consumer Price Index (CPI) rose 3.1 per cent on a year-over-year basis, matching the increase in October.[4] If mortgage interest costs are taken out of the CPI calculation, inflation sits at 2.2 per cent, close to the Bank of Canada’s target rate.[5]

“In Canada, we purchase homes with short-term mortgages of five years or less, in contrast to the situation in the U.S. where much longer 30-year terms are the norm. In a typical year, 25 per cent of our mortgages turn over. Consequently, during the period from 2023 to 2025, most homeowners in Canada will have transitioned to higher mid-single-digit borrowing. We will be required to adapt quickly, positioning our industry on a path to recovery more quickly than in the U.S. where the prospect of losing a below-market rate will act as a deterrent to moving.”

In 2024 and 2025, nearly half (45%) of all outstanding mortgages in the country will be up for renewal, according to the Canada Mortgage and Housing Corporation (CMHC).[6] That’s about 2.2 million households that will be renewing their mortgages, most at a much higher rate.

“Similar to what we witnessed last spring, when the Bank of Canada paused rates for the first time in a year causing sales activity and prices to increase almost immediately, the first sign of rate cuts – even if only by 25 basis points – could create a flurry of activity in the real estate market, releasing pent-up demand. Those who have been holding off listing their homes will follow close behind.”

Forecast

In December, Royal LePage issued its 2024 Market Survey Forecast, projecting that the aggregate price of a home in Canada will increase 5.5 per cent in the fourth quarter of 2024, compared to the same quarter in 2023.

Nationally, home prices are forecast to see modest quarterly gains in the first six months of 2024, with more considerable increases expected in the second half of the year, due to a boost in activity following a widely anticipated series of interest rate cuts by the Bank of Canada.

Royal LePage’s forecast is based on the prediction that the Bank of Canada has concluded its interest rate hike campaign and that the key lending rate will hold steady at five per cent through the first part of 2024.

Greater Vancouver

The aggregate price of a home in Greater Vancouver increased 2.7 per cent to $1,220,100 year over year in the fourth quarter of 2023. On a quarterly basis, the aggregate price of a home in the region remained relatively flat, decreasing by 0.7 per cent.

Broken out by housing type, the median price of a single-family detached home increased 5.4 per cent year over year to $1,731,900 in the fourth quarter of 2023, while the median price of a condominium increased 4.2 per cent to $762,600 during the same period.

“The last few months of 2023 concluded much as expected: a generally quiet period but not without some last-minute transactions being completed before the end of the year. Overall, sales activity and prices in the fourth quarter were consistent with the fall, and despite the typical seasonal slowdown, home prices in Greater Vancouver have remained stable,” said Randy Ryalls, general manager, Royal LePage Sterling Realty. “There remains a significant amount of pent-up demand from homebuyers waiting to return to the marketplace. It’s simply a question of when, a factor that hinges on the trajectory of lending rates.”

In the city of Vancouver, the aggregate price of a home increased 3.4 per cent year over year to $1,391,700 in the fourth quarter of 2023. During the same period, the median price of a single-family detached home increased 8.1 per cent to $2,244,200, while the median price of a condominium increased 5.5 per cent to $827,900.

“Looking ahead, we could see a brisk spring market, especially if fixed-rate loans continue to trend downward. This will spur significant activity,” noted Ryalls. “If we see the Bank of Canada begin to cut interest rates early in the year, competition among buyers could heat up quickly.”

Ryalls added that a significant boost in inventory will be needed to meet the demands of buyers coming off the sidelines.

In December, Royal LePage issued a forecast projecting that the aggregate price of a home in Greater Vancouver will increase 3.0 per cent in the fourth quarter of 2024, compared to the same quarter in 2023.

[1] Aggregate prices are calculated using a weighted average of the median values of all housing types collected. Data is provided by RPS Real Property Solutions and includes both resale and new build.

[2] Canadian Real Estate Association

[3] Bank of Canada maintains policy rate, continues quantitative tightening, December 6, 2023

[4] Consumer Price Index, November 2023, December 19, 2023

[5] Statistics Canada. Table 18-10-0004-13 Consumer Price Index by product group, monthly, percentage change, not seasonally adjusted, Canada, provinces, Whitehorse, Yellowknife and Iqaluit, December 19, 2023

[6] Rising rates on homeowners and the shocks that lie ahead, November 9, 2023

[7] Centris, Active listings for the month of December, from 2014 to 2023, Montreal Metropolitan Area.